The Best Strategy To Use For Truck Insurance In Dallas Tx

Wiki Article

Not known Facts About Insurance Agency In Dallas Tx

Table of ContentsTruck Insurance In Dallas Tx Can Be Fun For Anyone10 Easy Facts About Health Insurance In Dallas Tx ExplainedGetting The Life Insurance In Dallas Tx To WorkThe 3-Minute Rule for Health Insurance In Dallas TxHow Insurance Agency In Dallas Tx can Save You Time, Stress, and Money.See This Report on Health Insurance In Dallas Tx

And also since this protection lasts for your whole life, it can help support lasting dependents such as youngsters with impairments. Con: Expense & intricacy a whole life insurance policy can be significantly a lot more expensive than a term life plan for the same survivor benefit amount. The cash value part makes entire life extra intricate than term life because of costs, tax obligations, interest, and various other specifications.:max_bytes(150000):strip_icc()/4-types-of-insurance-everyone-needs.aspx-final-f954e12eb3074b178e4b53a882729526.jpg)

Bikers: They're optional attachments you can make use of to personalize your plan. Some policies include cyclists immediately consisted of, while others can be included at an extra expense. Term life insurance policy policies are generally the finest service for people that require inexpensive life insurance coverage for a particular period in their life.

Top Guidelines Of Insurance Agency In Dallas Tx

" It's constantly recommended you speak with a certified agent to identify the most effective option for you." Collapse table Since you're familiar with the fundamentals, below are added life insurance policy plan types. A number of these life insurance coverage options are subtypes of those included above, suggested to serve a specific purpose.Pro: Time-saving no-medical-exam life insurance coverage provides much faster access to life insurance without having to take the medical examination., likewise recognized as volunteer or voluntary supplementary life insurance coverage, can be made use of to link the coverage space left by an employer-paid group policy.

Unlike various other policy kinds, MPI just pays the death benefit to your home loan lender, making it a far more minimal alternative than a conventional life insurance coverage policy. With an MPI policy, the recipient is the mortgage company or loan provider, rather of your household, as well as the survivor benefit reduces gradually as you make home mortgage repayments, comparable to a decreasing term life insurance coverage plan.

The Single Strategy To Use For Truck Insurance In Dallas Tx

Since AD&D only pays out under specific circumstances, it's not an ideal alternative for life insurance policy. AD&D insurance policy just pays if you're hurt or killed in a mishap, whereas life insurance policy pays for the majority of causes of death. As a result of this, AD&D isn't appropriate for every person, yet it may be advantageous if you have a high-risk occupation.

Life Insurance In Dallas Tx - Questions

Best for: Couples who don't get two individual life insurance policy plans, There are two major types of joint life insurance policy plans: First-to-die: The policy pays after the first of the two partners dies. First-to-die is the most similar to a specific life insurance policy plan. It aids the making it through policyholder cover expenditures after the loss of economic support.They'll be able to help you contrast life insurance carriers promptly as well as conveniently, as well as find the finest life insurance firm for your situations. What are both main types of life insurance policy? Term and long-term are both main sorts of life insurance policy. The main distinction between both is that term life insurance plans have an expiry date, providing insurance coverage between 10 and also 40 years, as well as irreversible plans never run out.

Both its period and also money value make permanent life insurance policy many times extra More about the author pricey than term. Term life insurance coverage is generally the most cost effective and also extensive kind of life insurance policy since it's easy and also supplies monetary protection throughout your income-earning years.

Our Life Insurance In Dallas Tx Statements

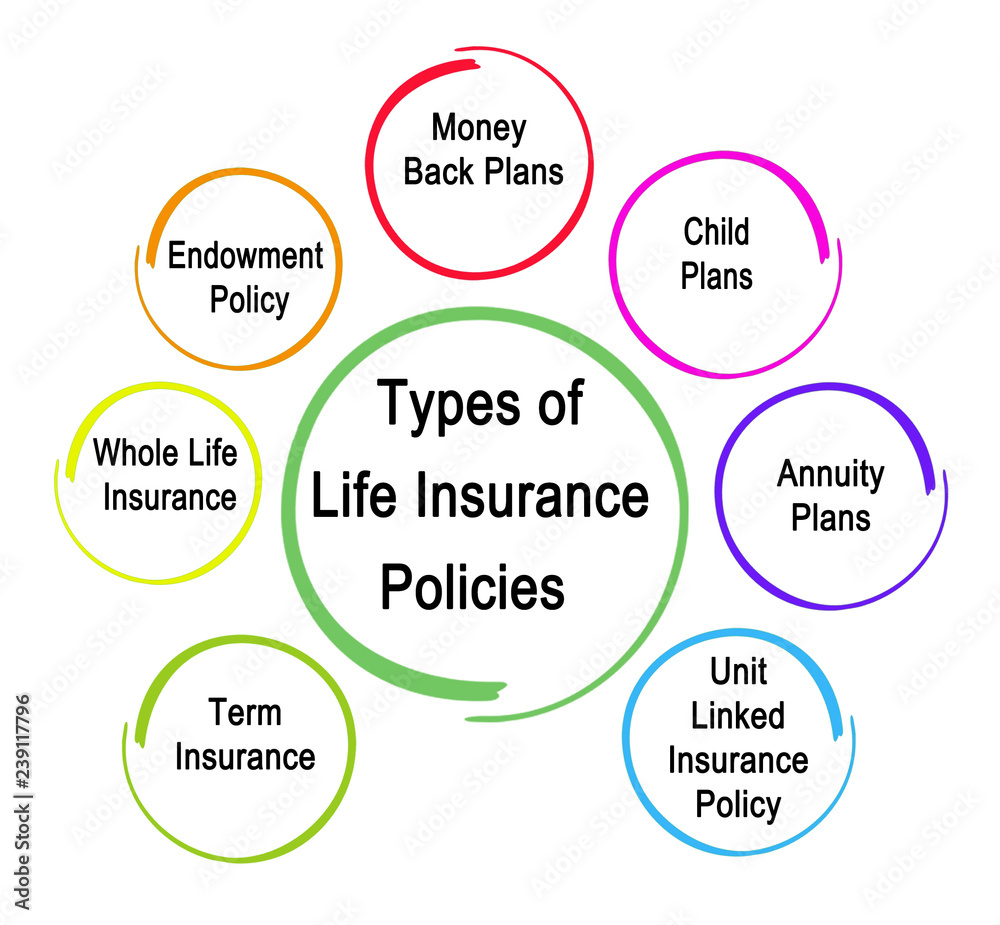

Entire, universal, indexed universal, variable, and also funeral insurance policy are all kinds of irreversible life insurance. Permanent life insurance usually comes with a cash money worth and also has greater costs.life insurance coverage market in 2022, according to LIMRA, the life insurance policy research study organization. At the same time, term life premiums stood for 19% of the marketplace wikipedia reference share in the exact same period (bearing in mind that term life costs are much less expensive than whole life premiums).

There are 4 fundamental components to an insurance coverage agreement: Statement Web page, Insuring Contract, Exclusions, Problems, It is necessary to recognize that multi-peril policies might have specific exemptions as well as problems for each and every kind of insurance coverage, such as crash protection, clinical repayment insurance coverage, obligation protection, and more. You will certainly need to see to it that you check out the language for the certain coverage that puts on your loss.

Insurance Agency In Dallas Tx - Questions

g. $25,000, $50,000, and so on). This is a recap of the significant guarantees of the insurance policy company and specifies what is covered. In the Insuring Contract, the insurance provider agrees to do particular points such as paying losses for protected risks, supplying certain services, or consenting to safeguard the insured in an obligation claim.Examples of excluded residential property under a home owners policy are personal home such as a vehicle, a family pet, or an airplane. Problems are provisions put in the plan that qualify or place constraints on the insurance firm's promise to pay or execute. If the plan conditions are not met, the insurance firm can refute the claim.

Report this wiki page